Insurance Recovery Program

Did you know that Florida homeowner’s pay 3-4 times the national average for insurance coverage and have some of the most extreme weather conditions in the country? would you believe that in most other parts of the country insurance companies actually pay for most new roofs because of extreme weather? Don’t you think Florida homeowners should have the same access to these programs as everyone else?

What is the Insurance Recovery Program (IRP)?

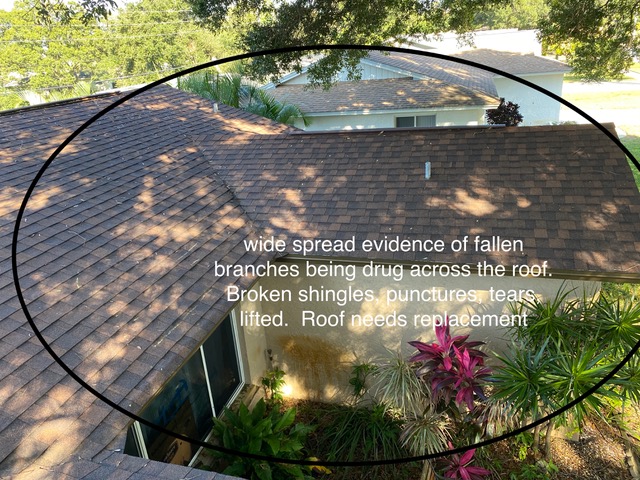

The Insurance Recovery (IRP) is a program where a representatie from our storm division conducts a thorough inspection of your property, including your roof. They will assess any possible damage and give an evaluation of whether or not your roof has damage significant enough for replacement. Sometimes only a minor repair is needed. This inspection is free of charge.

FAQS

Insurance policies almost always replace roofs damaged by “Acts of God”, such as a tree falling on your roof, hail, tornados, and hurricanes. *As long as the damage meets the threshold as dictated by your policy.

You would only be responsible for your hail/wind or hurricane deductible and nothing more.

No. Your insurance company may decide to pull out of the state and not renew policies but will not specifically cancel you because you filed a claim.

NOTHING for this service. If your insurance company denies your claim, you will be released from any obligation, including any contract, with Good2Go Roofing And Construction.

If we feel your roof has damage that should have been covered, we will absolutely recommend a reinspection.

No. Any unforeseen damages or requirements to provide a quality roof will be installed and we will bill the insurance company for those additional funds.

Contact Good2Go Roofing and Construction LLC – Roofing Contractors in Tarpon Springs, FL